In the contemporary regulatory climate, third-party verification (TPV) providers play a crucial role not only in ensuring compliance but in fostering trust between businesses and their clients. Any business interaction carries some level of risk, making third-party confirmation essential. TPV aids in enhancing transparency, policy adherence, and trust in legitimizing business-related transactions.

Understanding Third-Party Verification (TPV)

Third-party verification (TPV) is an independent process in which a third party validates transactional information between a business and its clients. This process is commonly used for verifying company sales and serves as a safeguard for both businesses and customers. The process ensures that the buyer and the seller understand and

agree on the terms in place regarding contract agreements, transfer of services, and purchase terms. Organizations implement third-party checks to mitigate disputes and ensure compliance with industry standards

The TPV process typically involves the following key stages:

Customer Agreement and Validation

After the customer agrees to a transaction, a live agent or an Interactive Voice Response (IVR) system confirms it, ensuring that the agreed terms are auditable. The customer responds to stipulated questions to confirm acceptance and understanding of the terms.

Document Safety and Compliance Measures

All confirmed agreements are stored as voice or text attachments for potential future audits. IVR systems automate verification, ensuring consistency and minimizing clerical errors.Moreover, these measures help the business avoid legal tangles and protect the privacy of the customers.

The Importance of Third-Party Verification

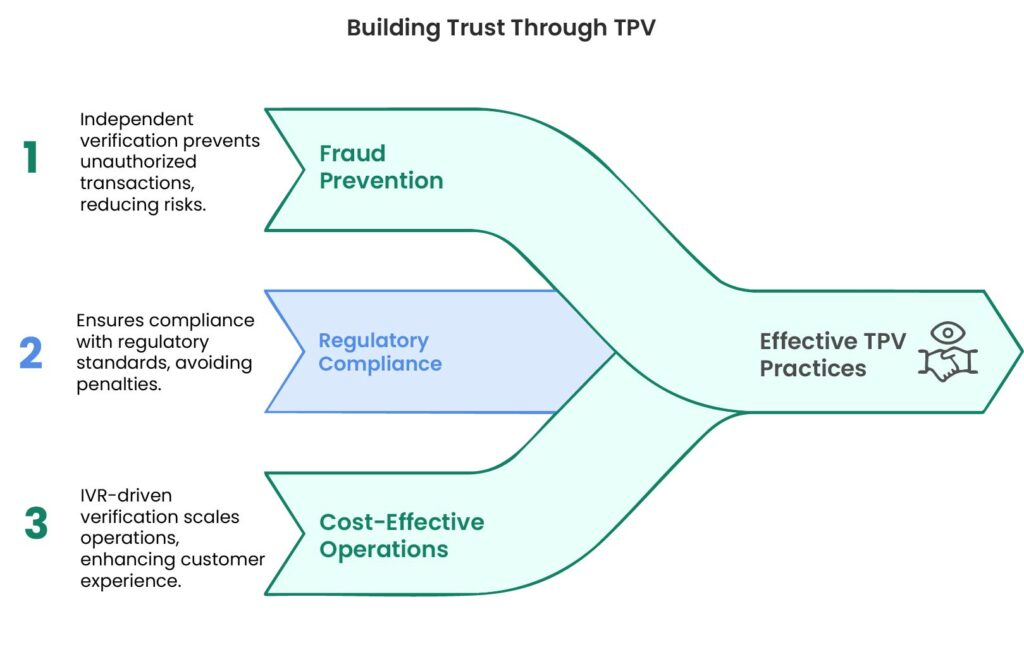

Establishing good TPV practices has many benefits, including preventing fraud, ensuring regulatory compliance, and fostering customer trust. Third-party verification ensures that transactions are conducted transparently and efficiently, with far less chance for fraudulent transactions and regulation infractions. In essence, TPV ensures that all business transactions meet compliance standards. Effective TPV practices offer:

- Fraud Prevention and Risk Mitigation: Independent verification provides a bulwark against unauthorized transactions, validating trust by customers and reducing financial risks.

- Regulatory Compliance and Audit Readiness: TPV solutions enable compliance with even the most demanding of regulatory standards, minimizing the risk of exposure to fines or reputational loss through non-compliance.

- Cost-Effective Operations and Customer Confidence:IVR-driven verification allows enterprises to scale efficiently while ensuring a seamless customer experience

Choosing the Right TPV Provider

Choosing the right TPV provider is key to long-term operational success and business growth.. The key things to look for are:

- Industry Expertise:

An experienced provider in a diverse range of industries will be able to successfully execute the critical processes of verification.

- Capability in Technology:

Sophisticated features like IVR technology and secure data storage facilitate increased precision and speed.

- Scalability and Security:

The selected provider should allow business expansion while guaranteeing strong security provisions to safeguard personal customer data.

AnswerNet: Your Trusted TPV Partner

AnswerNet has processed over 115 million verification transactions, combining cutting-edge technology with industry expertise to deliver reliable and compliant solutions. Our integrated approach—blending automated systems with experienced professionals—ensures seamless and secure verification processes tailored to your business needs.

If your organization aims to enhance compliance, mitigate risks, and build stronger customer relationships, AnswerNet is your ideal partner in achieving these objectives.